European Shipping Companies Far More Active on Northern Sea Route than Asian Ones

Arc7 LNG carriers loading liquefied natural gas from Yamal at the Port of Sabetta (Source: Courtesy of Novatek)

There are few Asian shipping companies and operators working on the Northern Sea Route compared to the number of European companies. Much more frequent voyages are also taking place between the NSR and European ports than ports in the Asian Pacific region, a new study by senior researcher Björn Gunnarsson at CHNL finds.

“There are much fewer Asian shipping companies working on the NSR [Northern Sea Route] than European companies, contrary to media reports that often depict a large Asian shipping influence on the NSR,” according to Associate Professor and Senior Researcher Björn Gunnarsson at the Centre for High North Logistics (CHNL).

In a recently published article by Marine Policy, Gunnarsson looks at ship traffic and developing shipping trends on the NSR in the period from 2016 to 2019. His research shows that shipping activity along the Northern Sea Route, off the northern coast of Russia, is increasing rapidly.

From 2016 to 2019, the number of voyages increased from 1705 to 2649, or by 58 percent. During the four years, the cargo volume on the NSR increased from 7.5 to 31.5 million tons. Most of the cargo consisted of liquid hydrocarbons for export to the European market.

According to the study, the increase in the number of voyages was the result of more internal traffic on the NSR as well as increase in destination shipping between Southwest Kara Sea and European ports, by LNG [liquified natural gas] carriers and gas condensate tankers.

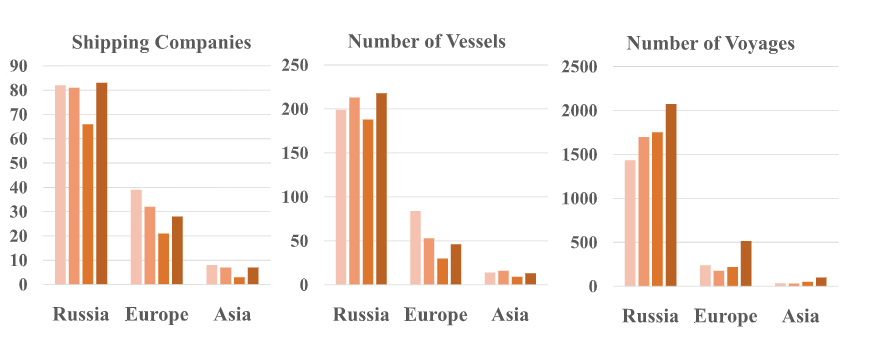

In analyzing the international traffic during the period, Gunnarsson finds that there were much fewer Asian shipping companies working on the NSR than European companies. Much more frequent voyages are also taking place between the NSR and European ports than ports in the Asian Pacific region.

To High North News, Gunnarsson says many of the Asian shipping companies, led by the Chinese COSCO Shipping, have mainly expressed interest in international transit shipping on the NSR; a voyage that goes between two non-Russian ports, but via the NSR.

European shipping companies were on the other hand much more involved in domestic shipping on the NSR, with up to 23 companies working each year, providing general cargo vessels, bulkers, heavy lift carriers, and offshore support vessels. Most of these voyages were between Murmansk and Sabetta and locations offshore in the Kara Sea and in the Ob Bay.

Gunnarsson adds that companies based in Northwestern Europe had a logistical advantage compared to Asian companies due to shorter travel distance to the Ob Bay. European vessels, during the period studied, could also provide several ice-strengthened vessels and many of the companies had extensive experience in ice navigation during winter operations in the Baltic Sea.

Overall however, Russian domestic shipping activities on the NSR are the largest in terms of number of shipping companies, vessels and voyages.

Russian owned/operated shipping companies were 62–73 percent of all shipping companies working on the NSR in 2016–2019, and owned/ operated 66–83 percent of all vessels and made 75–87 percent of all voyages.

Also read

Domestic significance

What do you think of the future numbers and roles of European companies operating on the NSR?

"It is likely that European shipping companies will be equally involved in project development for the upcoming Arctic LNG-2 plant and the Utrenniy terminal in the Ob Bay, due to start operations in 2023, as was the case for Yamal LNG. As before this will include transport of prefabricated LNG modules, dredging and support for offshore operations," Gunnarsson says.

The senior researcher notes however that Russia will not be as dependent on foreign shipping companies in the medium to long-term as it was for the Yamal LNG project.

“The experiences gained from the Yamal LNG project will enable Russia to speed up its own LNG project development. According to President Vladimir Putin, Russia will strive to become the world’s largest LNG producer, and to reach the president’s goal Russia needs to put much more emphasis on LNG technologies, engineering and plant manufacturing.”

The Russian government has also put in place several regulations that may impact international traffic on the NSR, such as amendments to the Russian Merchant Shipping Code that only allow Russian flag vessels to transport Russian hydrocarbon resources within NSR borders. Gunnarsson says such regulations will have major future implications for foreign cargo vessels servicing new energy projects along the NSR.

"The changes are meant to strengthen the role of Russian shipping industry and shipping companies, and sets the tone for Russia’s increasing control of future shipping on the NSR with its natural resources.”

As High North News has reported on, President Putin sees the route as key for development of the Russian Arctic and the Far East.

“NSR is of high strategic and economic significance for Russia as a transport corridor along its whole Arctic coastline and as a gateway to the North Atlantic Ocean in the west and to the North-Pacific Ocean in the east," the senior researcher adds.