Cargo Volume on Northern Sea Route Remains Stable at 32m tons in 2020

Sovcomflot tanker traveling along the Northern Sea Route. (Source: Sovcomflot)

After years of significant growth the amount of cargo transported on Russia’s NSR is forecasted to reach 32 million tons, similar to last year’s 31.5m tons. Lack of sea ice now allows non ice-class vessels to travel the route and Norwegian company Scana was contracted for Novatek’s LNG project.

Cargo volume on Russia’s Northern Sea Route (NSR) is expected to reach 32 million tons in 2020 according to the latest forecasts. Traffic is up from just 2.8 million tons in 2013 and 18m tons in 2018.

"The plan for this year's freight traffic along the Northern Sea Route was 29 million tons, but today our forecast is that it will exceed 32 million tons," Alexey Likhachev, the head of Russia’s State Atomic Energy Corporation and operators of the country’s icebreaker fleet, Rosatom, said earlier this week.

The development of the route is a national priority with strong support from President Putin, who sees the route as a key for development of the Russian Arctic and the Far East and wants to develop it into a global competitive transport route.

The stark increase in traffic over the past ten years comes primarily from two large hydrocarbon developments: Gazprom’s Novy Port crude oil project and Novatek’s Yamal LNG project. Both are located on the Yamal peninsula and utilize ice-hardened vessels to export crude oil and LNG via the NSR.

Novy Port produced 7.7 million tons of crude oil in 2019 and Yamal LNG produced 18.4 million tons. Combined the two operations account for 26.1m tons or around 80 percent of cargo volume on the route.

No ice means no ice-class needed

For most of the year Novatek relies on a fleet of twelve Arc7 icebreaking LNG carriers to travel through the ice-covered waters along the NSR. However, in recent years ice has receded so much that even conventional vessels can venture into the Arctic during the late summer and early fall.

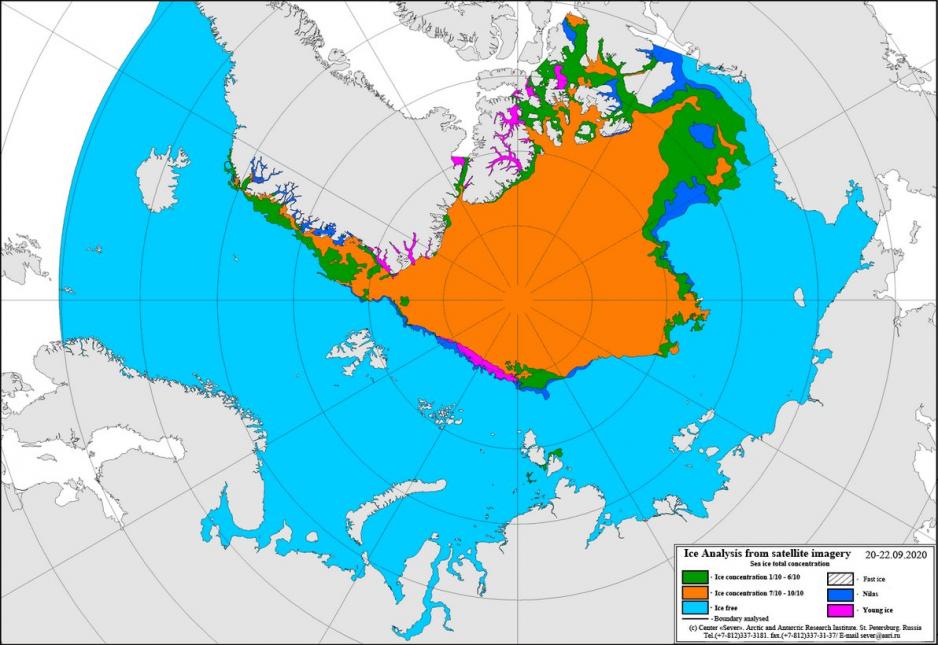

Just last week it was announced that Arctic sea ice reached its second-lowest ever extent.

The waters along the Russian coastline were completely ice free during September and a non-ice strengthened LNG carrier is currently passing through the Bering Strait on route to the port of Sabetta and the Yamal LNG project.

Ice-free waters along Russia’s NSR in September 2020. (Source: Russian Meteorological Service)

The LNG tanker Phecda received permission from Russia’s NSR Administration to navigate independently, meaning without any icebreaker assistance, along the route. The vessel departed from Shanghai in China earlier this month and is expected to arrive in Sabetta on October 10.

Scana contributes to floating LNG storage units

In the near future Novatek will begin using floating storage units (FSU) to transfer LNG from its Arc7 carriers to non-ice capable LNG carriers. The former will transport LNG through the icy parts of the NSR to year-round ice free waters near Murmansk and Kamchatka, where the cargo will be stored aboard the FSUs and will then be transferred to conventional LNG carriers.

For this purpose Novatek ordered two floating transshipment hubs from Korea’s Daewoo Shipbuilding & Marine Engineering (DSME) earlier this year and last week announced that it secured financing for their construction. Delivery is expected in 2022. Novatek had first announced plans for a transshipment hub in 2017.

Graphic of an Arc7 ice-capable carrier, Floating Storage Unit, and conventional LNG carriers. (Source: Novatek)

Russia’s Gazprombank will provide a $613m loan to Novatek for the construction of these two massive floating LNG storage hubs. Each facility will be able to hold around 180,000 tons of LNG, equivalent to two shiploads from the Arc7 carriers.

DSME has begun subcontracting for parts of the construction. Norway’s Scana, via its subsidiary Seasystems, received a contract last month for the delivery of mooring equipment for the two floating storage units. “This is a major contract for us, and it once again confirms the leading expertise our engineers have in robust and cost-effective mooring systems,” explained Torkjell Lisland, Managing Director of Seasystems AS.

Seasystems will provide 72 hull brackets and chain stoppers, which DSME will install on the FSUs. Production will begin this November with the first deliveries in February 2021. “The contract shows that even though we are a small company, we offer technological product solutions that are attractive to a wide range of market segments,” confirms Lisland.

Testing the waters

In fact, Novatek and its shipping partners have already begun testing the suitability of the waters around Kildin Island in the Barents Sea as a location for floating storage unit. The Arc7 carrier Christophe de Margerie successfully completed a test call at the Kildin Vostochny temporary anchorage transhipment complex in August.

Christophe de Margerie testing the Kildin anchorage (Source: Sovcomflot)

The test was an important step towards developing the logistics surrounding Yamal LNG. The ship-to-ship transfers from Arc7 carriers to conventional LNG carriers will optimize the utilization of the Arc7 carriers and increase the efficiency of Novatek’s operation.

Both FSUs are designed for a throughput of around 20m tons of LNG a year. The Kamchatka terminal is expected to begin operation in 2022 and the Murmansk location will follow in 2023.

By 2030 Novatek expects to ship 57m tons of LNG per year from its Arctic LNG projects. Around 80 percent of production or 46m tons will be shipped along the NSR to Asian markets. At this volume Novatek will likely add a second FSU in Kamchatka in order to have the capacity to transship up to 40m tons.